Features Of The Best Pool Deck Resurface And Concrete

Related Post

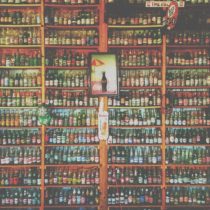

Getting The Right Shelving For Your BusinessGetting The Right Shelving For Your Business

Shelving plays a significant role in ensuring that your business becomes a success. It is always important that you take into consideration the weight of the materials that you intend to use the shelves for. You need to understand that too much weight will cause the shelves to hang. Heavy retail shelving can help you to maximize the space of your room without compromising the overall safety. Here are some of the considerations that you need to make before settling on a single shelve installation for your business.

Dimensions

The first thing that you need to take into consideration when you need the installation of shelves in your premises is the available space. Think about the purpose that you intend to use the shelves for. After that, you can decide on the dimensions that your shelve need to have. The right dimensions will go a long way in ensuring that your space is properly utilized.

Still, on the matters related to dimensions, it is a good idea to make sure that your shelves are neither too long nor too short to make their use a bit challenging. Carefully measuring the dimensions of your shelf enables you to know how many shelving units that can fit into a given place.

Adjustable shelving

In this modern era, everything seems to be dynamic in one way or the other. So this, therefore, tells you that you need to have plenty of flexibility and versatility in the whole process of installing shelves in your business units. This is very critical as it helps you to make any changes that might arise while you on your daily operations.

There is also the possibility of your business growing and becoming more complicated. In such instances, you will need to have a flexible shelving system that will be able to take care of such changes.

Durability

The durability of the shelving system is very important. Here you need to closely examine how the company that will install them for you does. Find out on the quality of the materials that they are going to make use of. Make sure that they are professionally made to prevent them from breaking.

Assembly

You also need to look at the process that is used in the assembling of the heavy duty shelving units. The assembling process needs to be simple and easy for anyone to perform it without many difficulties. This is significant because sometimes the shelves may sometimes develop some damages. In that case, you do not have to call the company that installed them for you but do the repair on your own.

You also need to look at the process that is used in the assembling of the heavy duty shelving units. The assembling process needs to be simple and easy for anyone to perform it without many difficulties. This is significant because sometimes the shelves may sometimes develop some damages. In that case, you do not have to call the company that installed them for you but do the repair on your own.

Learn The Truth About 12 Week MasteryLearn The Truth About 12 Week Mastery

To succeed in business, it is not enough to have good ideas. You also need to have the right skills, and you must know how to be very productive. What many people don’t know is that productivity is a skill that can be learned. Many books and programs teach productivity, but one of the most promising one in the market is 12 week mastery by Brian P. Morgan, Todd Brown and Tom Beal. This article will tell you the truth about 12-week mastery.

Benefits

World-class team

In evaluating any book or training program, of course, one would need to look at its creators. As mentioned above, 12 Week Mastery is created by not one, not two, but three individuals who are considered masters in their fields. You can read 12 week mastery reviews to understand the program better. Brian P. Moran is an author and this program is based on his bestselling book “The 12 Week Year.” Joining Brian is Tom Beal, the creator of Remarkable Marketing and Todd Brown, the founder of Marketing Funnel Automation.

The two agreed to be part of the program because their lives were completely transformed by the techniques presented by Brian in his book. Combined, the creators of the 12 Week Mastery has more than 30 years of combined experience and knowledge among them. This is why they are very confident that whoever tries this program will surely succeed in business and life.

For success seekers

Anyone who wants to succeed in life will benefit from the 12 Week Mastery. Whether you are an entrepreneur who owns a small business or someone who belongs in a large organization, you will surely benefit from the lessons that are taught in the program. To achieve your goals, there are several skills that you need to master.

These includ e planning, motivation, and focus. You can learn these skills from other sources. What sets this program apart from others in the market is that it can teach you these skills in more in 12 short weeks. Hence the name 12 Week Mastery. If you are looking for a short cut to success, this is it.

e planning, motivation, and focus. You can learn these skills from other sources. What sets this program apart from others in the market is that it can teach you these skills in more in 12 short weeks. Hence the name 12 Week Mastery. If you are looking for a short cut to success, this is it.

The truth

The truth about 12 Week Mastery is that it is not a scam. It is created by truly successful individuals who want to share their knowledge with other people. In this program, you can find valuable lessons that you can immediately use to achieve any goal. And the best part about this program is that it gets results fast. You don’t have to wait for years.

What to Consider When Hiring a Line Marking ContractorWhat to Consider When Hiring a Line Marking Contractor

Line marking is vital when it comes to improving a parking lot. Line marking is done throughout the town, including schools, government buildings, malls, store outlets, tourist attractions and commercial properties. It involves creating directional lines in parking lots which designate parking areas, traffic flow, out-of-bound areas and handicapped spaces. Every commercial parking lot uses line stripping that improves the parking lots by marking the parking. Below is a guide for hiring the right line marking contractor.

Cost

It would help if you got a professional who can offer cost-effective and affordable rates. Whereas unlicensed contractors or freelancers can offer the cheapest rates, they may give the lowest quality of service. Professional companies, on the other hand, may overcharge. Get a professional line marking contractor who offers competitive rates and who can breakdown the costs beforehand.

Advanced Machinery

Line painting is not usually done with the help of a paintbrush, paint roller or spray paint. It is done using advanced machinery to accurately and safely place lines on a property. You need to inquire about the technology and machinery the contractor will use to get the job done before you choose to hire a given contractor.

Previous Projects

You will need to check out past projects handled by the contractors to know the quality of the contractor’s work. Take your time to inquire about previous properties that the contractors worked on in your area and explore them personally. This will give you an excellent idea of the quality of work the contractors do.

Experience

Line striping will take considerable skill and needs the use of high-end machinery in the industry. Ensure you go for contractors who have enough experience. Line marking needs to be done to ensure alignments of all the lines in precise places as you want them to be to prevent accidents as well as other problems. It is wise to look for companies with trained and licensed professionals. Line marking contractors also need to have experience with properties similar to yours.

Line marking in properties helps in improving safety, reducing liability and increasing curb appeal. Also, roads feature clear line marking since it is vital for navigation and safety. If line marking is properly done, drivers will avoid collisions. The traffic flow will also be improved and chances of injuries to pedestrians. You will achieve all this by hiring the right line marking contractor for your property. These tips will come in handy when choosing one.